Introduction

Share markets have seen big falls on the back of rising recession fears. For the last two years there has been constant fears of a recession – or a contraction in economic activity – on the back of central bank rate hikes. With it failing to materialise and inflation falling enabling central banks to pivot to rate cuts many thought it would be avoided, and shares surged to record highs into July. However, recession fears are now back with a vengeance, particularly in the US, so share markets have fallen sharply from their highs – with the key direction setting US share market down 8.5% and global shares off 8.9% and Australian shares having a 5.7% fall from its high last week. What’s more, bond yields, commodity prices and the $A are all down consistent with renewed growth concerns. This may have been accentuated by an unwinding of so-called Yen carry trades (where investors borrow cheaply in Yen and invest globally) after the Bank of Japan raised interest rates. Even Bitcoin has had a near 30% fall from its July high indicating again it’s become a leveraged version of shares. So why the sudden recession worries? How serious is the risk? Does it mean central banks including the RBA have got it wrong? And what does it mean for investors?

More US recession indicators flashing red

The basic argument for recession over the last two years is that the most rapid monetary tightening in major countries in decades and cost-of-living pressures would depress spending driving a recession. Indeed, the Eurozone, UK and Japan have seen growth stall or arguably have had mild recessions over the last 18 months and Australia is already in a “per capita recession” (with falling GDP per person) even though GDP has still been rising. But the US economy has been robust, and this has kept the key direction setting US share market strong until recently. However, while the US economy has been stronger than expected, the risk of recession never fully went away, with key indicators highlighting ongoing recession risk. In particular:

-

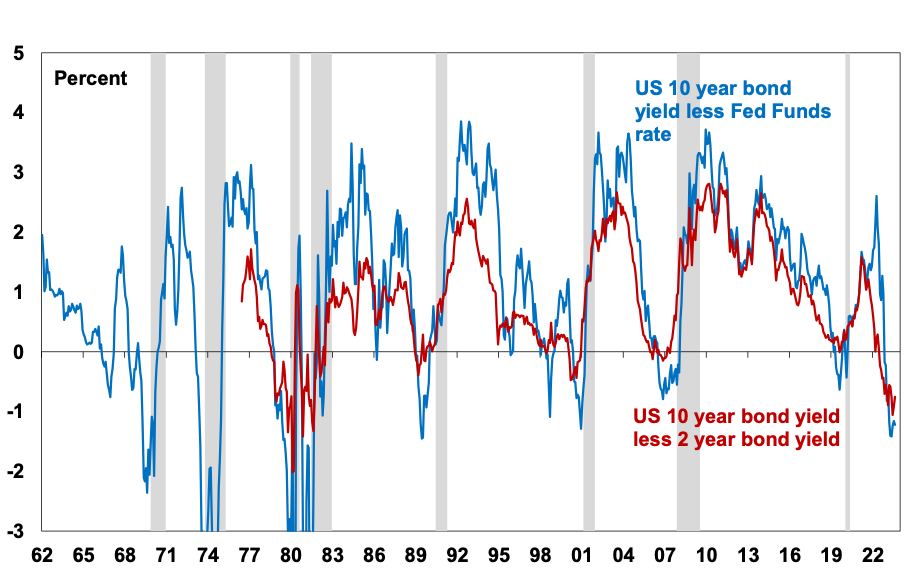

The US yield curve which is a guide to whether monetary policy is tight or loose has been flashing red, with short term interest rates above long-term rates, since 2022. And while this has given false signals it has preceded all US recessions over the last 60 years. It’s still inverted and so its recession signal remains.

US yield curve inversions and recessions

Shading shows recessions defined by the US National Bureau of Economic Research. Source: Bloomberg, AMP

-

The US leading economic index – which combines things like building permits & confidence – has had a fall consistent with past recessions.

There is nothing new here. And with global growth running around average levels, business conditions indicators remaining solid and US growth still strong many concluded the recession indicators just got it wrong. However, the resilience in economic growth could have just been due to (what Milton Friedman long ago called) the “long and variable lags” with which monetary policy impacts economic activity. And the impact of rate hikes was stretched out this time by the reopening boost from the pandemic, household saving buffers built up in the pandemic and strong labour markets partly reflecting a shortage of workers.

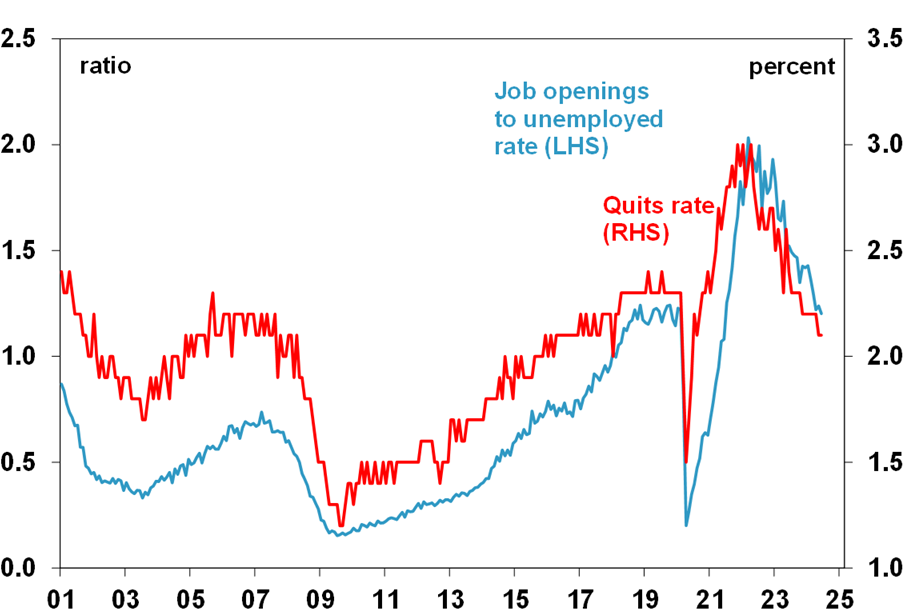

These supports are now fading. Weakening US jobs data suggest that it may indeed have been long lags at work. US job openings and people quitting for new jobs have been falling for some time now. Initially this may have been benign as slowing labour demand just pushed down job openings (and wages growth) but with unemployment remaining low.

US Job Openings and Quits

Source: Bloomberg, AMP

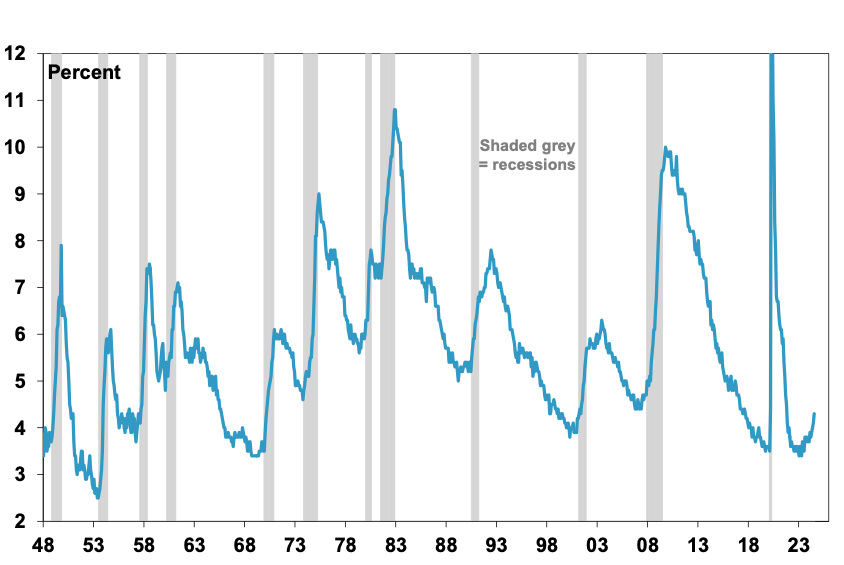

However, now falling labour demand is showing up in higher unemployment. Historically, small increases in US unemployment tend to be benign but once it goes beyond 0.5 percentage points it tends to keep rising and become associated with a recession as higher unemployment leads to lower spending in the economy. Based on this a US economist named Claudia Sahm observed that whenever the 3-month moving average of the unemployment rate rises by 0.5% above its prior 12 month low a recession has been underway. This has become known as the Sahm Rule and it was triggered by July jobs data in the US on Friday with unemployment spiking to 4.3%, up from a low of 3.4%. It can be seen at work in the next chart. It has a perfect track record, but relationships that work in the past don’t always work in the future and it may have been distorted by a lumpy 420,000 rise in the labour supply in July. That said it’s hard to ignore and suggests along with the still inverted US yield curve and the slump in the US leading indicator that recession risk is now very high in the US. Which is why share markets have plunged and the US money market is now back to allowing nearly 5 rate cuts this year. Recall it was expecting nearly 7 cuts early this year, so it’s almost gone full circle!

US Unemployment Rate and Recessions

Shading shows recessions as defined by the US NBER. Source: Bloomberg, AMP

What about Australia?

Leading indicators of Australian economic growth have not been as weak as those in the US. However, there are several reasons for concern that Australia may follow the US. We put the risk of recession here at 50%:

-

Interest rates have gone up by more in Australia than in the US as measured by the mortgage rates people actually pay.

-

Household debt servicing costs are now at a record share of household income in Australia (which is not the case in the US), and Australia has far more overvalued housing than in the US.

-

Australian real household spending has slowed to a crawl.

-

The boost to Australian economic growth from record population growth looks set to slow over the year ahead by at least one percentage point. This will more than offset the boost from tax cuts.

-

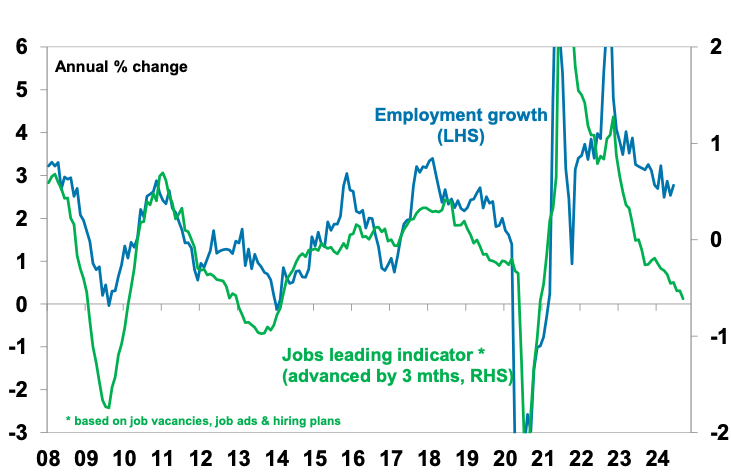

Like in the US job vacancies have been falling here for two years and this will likely soon feed through to a sharp slowdown in jobs growth and rise in unemployment which is already up to 4.1% from 3.5%.

Australian employment vs Jobs Leading Indicator

Source: ABS, AMP

-

US recession will drag down global growth which will mean less demand for our exports and indirectly impact via confidence.

Have central banks, including the RBA, got it wrong?

The global monetary policy easing cycle is now underway. However, while lower interest rates are good for shares, this is less so initially in a recession and share markets are signalling increasing concern central banks may have left it too late. Central banks, including the RBA, may not have allowed enough for the “long and variable lags” with which rate hikes impact growth and inflation and so overtightened or left rates too high. This has likely been made worse by the pause in progress getting inflation down over the last six months in the US and then in Australia. Because central banks never know when they have raised rates enough to control inflation they often go too far – resulting in recession. This was the case prior to recessions in Australia in the early 1980s and 1990s. While the RBA still faces inflation that’s too high, given the US experience it should now be giving consideration to a cut in interest rates as it now risks much higher unemployment and inflation falling below target.

What will recession mean for Australians?

A recession normally sees higher unemployment – the early 1980s and 1990s recessions saw a 5 percentage point rise, less job security, lower wages bargaining power, a fall in living standards and low confidence. Recessions eventually also mean lower growth in the cost of living and often lead to lower levels of immigration and less household formation which could take pressure off rents and home prices.

What would be the impact on shares?

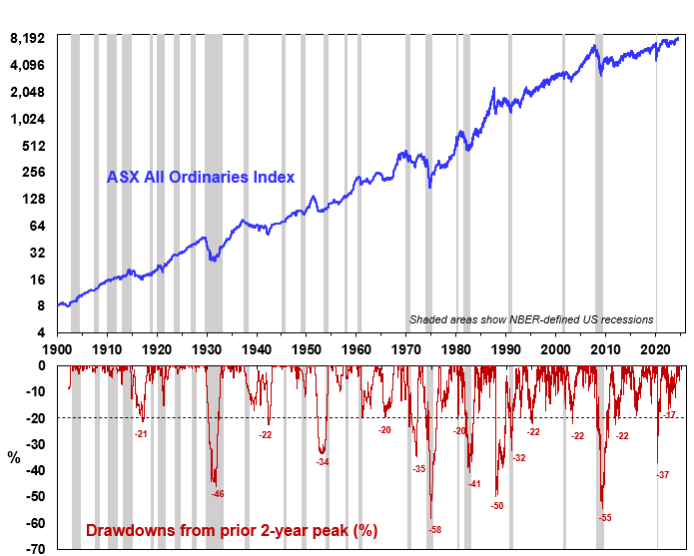

Recessions in Australia and the US have tended to be associated with bear markets in shares, ie, 20% or more falls, as they drive a slump in profits. The next chart shows the Australian share market and falls in it against US recessions. Shares are vulnerable now as valuations are stretched, investor sentiment has been high, geopolitical risk is high with the US election and escalating problems in the Middle East and August and September are often rough months. So, it’s likely too early to buy the dip!

Equity Bear Markets and Recessions

Shading shows recessions as defined by the US NBER. Source: ASX, Bloomberg, AMP

Implications for investors

While times like these can be stressful, for superannuation members and most investors the best approach is to stick to an appropriate long term investment strategy to take advantage of the rising long-term trend in share markets given the difficulty in trying to time short-term swings.

Dr Shane Oliver – Head of Investment Strategy and Chief Economist, AMP

Source: AMP Capital August 2024

Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) make no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.